Study on Volatility of Stock Market:Empirical Analysis Based on ARMA-TGARCH-M Model

-

摘要:

通过构建ARMA-TGARCH-M模型,并同时利用上证综合指数和深圳成份指数的低频日收益率和5分钟高频收益率数据,对中国股票市场的波动性问题进行了实证研究。结果表明:中国股票市场存在着大幅度高频率波动,市场总体风险较大,而且收益率波动也存在着波动集群性、尖峰后尾性和非对称分布等特征,深圳股票市场在各方面的特征也都比上海股票市场突出。此外,低频日收益率序列和5分钟高频收益率序列都存在着显著的平稳性、自相关性和ARCH效应,中国股票市场还存在着较长的外部冲击波动持续期,且杠杆效应显著。GARCH族模型能够很好地拟合中国股票市场的波动性问题。

Abstract:This paper conducts an empirical test of the volatility of the stock market in China, by building the ARMA-TGARCH-M model, and using the data of low-frequency daily yield and high-frequency five minutes yield of Shanghai Composite Index and Shenzhen Component Index simultaneously. The empirical results show that there is a substantial high-frequency fluctuation in China's stock market, and that the overall market risk is high. Moreover, there are characters of volatility clustering, peaky kurtosis and thick trail and asymmetric distribution in the yield volatility of stock market in China; and the stock market in Shenzhen is more prominent in all those characteristics than the stock market in Shanghai. In addition, there are significant stability, self-correlation and ARCH effect, long external shock volatility duration, and the significant leverage effect as well. GARCH Models can be fitted well to the problem of the volatility of the stock market in China.

-

Keywords:

- stock market /

- price volatility /

- ARMA-TGARCH-M /

- high frequency data /

- risk /

- shanghai and shenzhen stock market

-

一、 引言

自深圳宝安县联合投资公司首次公开募股以来,中国的股票市场已走过30年的发展历史。然而与西方国家发达的资本市场相比,中国的股票市场仍然很不完善,在整个中国都处于制度变迁的大背景下,在某些特定时期中还会出现频繁剧烈的波动。而保持股票价格及收益率的相对稳定,防止股票价格的大幅度波动,是任何一个股票市场健康运行的内在要求。因此,一直以来监管机构和各类投资者都十分关注中国股票市场的波动性特征及其影响因素,而掌握股票市场波动性的基本特征与一般规律不仅有利于监管机构的高效规范管理,更有利于各类投资者进行科学的风险防范和理性投资。鉴于此,股票市场波动性问题研究对于揭示股票市场运行规律,促进中国股票市场健康发展有着积极的促进作用。

股票市场的波动是对股票价格随机性与变异性的测度,是对股票收益率不确定性的描述。而早期关于股票市场波动性的研究都假定收益方差不随时间变化,但后来大量的实证研究发现了金融时间序列的尖峰厚尾性、波动集群性与非对称性等特征[1],这奠定了当今金融时间序列建模分析的最普遍的时变方差等理论假定。长期以来,理论界都希望通过计量模型对股票市场波动性及其特征进行准确模拟,为此也提出了大量的模型方法,其主要有两大类,其一是自回归条件异方差(Auto Regressive Conditional Heteroskedasticity,ARCH)模型。Engle在对英国通货膨胀问题进行研究时发现,时间序列模型的预测误差决定于扰动项滞后期数,于是他开创性地提出了能够良好刻画金融时间序列异方差性与波动集群性特征的ARCH模型。[2]987-1008Bollerslev则在此基础上对ARCH模型进行了扩展,产生了考虑误差项滞后项与误差项条件方差滞后项的GARCH(Generalized ARCH)模型。[3]307-327与ARCH模型相比,GARCH模型能够成功解决ARCH效应与过度拟合等问题,并且形式简洁,因此,也比ARCH更优秀。鉴于ARCH模型和GARCH模型都缺少对杠杆效应的考虑,Nelson、Zakoian又先后提出了指数E-GARCH模型与门限T-GARCH模型。[4][5]202-226这些模型构成了ARCH类模型族的基础模型,大量学者在此基础上进行了扩展与应用,ARCH模型也因此成为了当前理论界研究股票市场波动性问题的主要方法之一。其二是随机波动(Stochastic Volatility,SV)模型。Clark和Thomas提出了股票市场收益率取决于随机信息的假定,并由此产生了股票收益率的时变波动率模型。[6]Taylor等则进一步在Tauchen和Pitts混合分布模型的基础上提出了标准的离散时间SV模型(SV-N),并用以解释金融收益时间序列波动模型的自回归行为。[7-8]而为了模拟金融收益时间序列的尖峰厚尾性,Kim和Shephard又提出了随机扰动项服从t(w)分布的SV-T模型。[9]Koopman和Uspensky则更是将ARCH-M模型推广到SV模型中,并由此产生考虑了预期收益与风险补偿关系的正态分布SV-MN模型。[10]667-689此外,还有同时考虑预期收益与风险关系的SV-MT模型以及Harvey和Shepherd的杠杆效应SV模型(Leverage SV)。

在实证研究方面,多个股票市场中均存在着股票市场报酬率对于信息反应不对称的现象。Lo认为西方发达国家的股票市场只具有很小的长期记忆性。[11]而Karolyi利用BEKK模型和VAR-GARCH模型考察了纽约与多伦多股票市场的波动性传递问题,他们发现,GARCH模型能够很好地揭示两市场之间的动态传递性,并且每一个市场的波动都滞后影响另一个市场。[12]Andersen等提出了度量股票市场高频收益率波动的“已实现波动率”的概念,他们将已实现波动率与条件协方差矩阵结合起来进行实证分析,研究结果表明,基于日益实现波动率的长记忆高斯VAR模型在波动率的预测上要明显优于GARCH模型。[13]而Koopman等建立了加入RV作为解释变量的扩展SV模型(SV-RV模型)和扩展的ARFIMA模型(ARFIMA-RV模型),实证结果显示,加入RV也可以显著地改善传统波动模型的预测能力。[10]667-689Fornari和Mele则考察了股票市场波动与经济基本面之间的互动,发现在战后“大缓和”(Great Moderation)期间,美国股票市场的波动能够预测实体经济波动的55%。[14]而中国国内学者翁黎炜和黄薇、张婧同时利用几种不同的ARCH类模型对中国股票市场的波动性问题进行了考察,结果表明中国股票市场波动存在显著的ARCH效应、杠杆效应与非对称性,且波动持续的时间较长。[15-16]文凤华等基于滚动样本检验的研究成果说明中国股票市场的波动非对称性是随着时间而演变的。[17]邓晓益和郭庆春则利用GARCH模型对上海股票市场的日收益率进行分阶段分析,他们的主要结论是,熊市利空消息产生的波动要比利好消息产生的波动大,而牛市利好消息产生的波动要比利空消息产生的波动大。[18]而周孝华和吴命构建了市场活跃度指数,并通过双元EC-EGARCH-M模型对上证综指和深圳成指进行了实证研究,其结论是市场活跃度指数和协整残差项对条件均值方程和条件方差方程都有很好的解释力。[19]陈其安等考察了宏观经济环境和政府调控政策对股票市场波动性的影响,研究结果表明,中国股票市场对宏观经济环境变化的反映功能存在一定程度的缺失,财政政策的调控功能基本上处于失效状态,利率政策在现实经济环境中也未能发挥作用,货币供应量政策因其直接影响股票市场资金供给而产生了明显的影响。[20]

此外,梁益年在考察股市联动性时发现,上证综合指数和深证成份指数在变化趋势和指数收益的波动密度上都有趋从性,具有极其相似的相关度,而且二者之间的波动传递相当显著,但上证、深证与亚太地区中的其他股票市场的互动性较弱,说明中国股票市场具有相对的波动独立性。[21]郑冲更是直接以“中国股市波动性的影响因素研究”为题,基于多因素交互效应的视角对中国股票市场波动性的影响因素进行了细致研究,系统呈现了影响中国股票市场波动性的核心因素以及其影响股票市场的一般机理。[22]近年来,大量学者认识到具有设定谬误的计量模型难以产生正确的研究结论,并因此建议在金融时间序列计量建模分析中使用非参数方法。鲁万波在不考虑GARCH模型形式与收益率条件异方差分布假定的条件下,运用非参数GARCH(1,1) 模型研究了中国股票市场的波动性问题,并通过预测误差度量指标的比较分析得出,非参数GARCH(1,1) 模型对中国股票市场波动性问题的刻画更准确。[23]杨二鹏等通过多项式样条估计方法和局部线性估计方法对沪深300指数的波动性非参数模型进行了估计,他们认为,基于多项式样条估计的非参数模型对中国股票市场的波动性问题能够进行优良的刻画。[24]

综上所述,国内外学者都对股票市场波动性问题进行了广泛的研究,在此过程中也提出了大量的计量模型方法,并对全球股票市场进行检验分析,形成关于股票市场波动性问题的一般性研究结论。但鉴于中国股票市场的不成熟性与制度变迁过程的特殊性,西方发达国家成熟股票市场波动性的一般规律并不一定适用于中国股票市场,而理论界仍缺乏对中国股票市场波动性问题的深入研究,尤其是缺乏使用包含更加丰富波动特征信息的高频数据的研究,同时运用高频数据和低频数据的实证研究就更少了,而Baillie的研究成果早已证明了高频数据在股票市场波动性分析中的巨大优势。[25]鉴于此,文章将先构建股票市场收益率时间序列的ARMA模型,并利用TGARCH-M模型处理时变方差问题,因为这样能够较好解释股票市场收益率时间序列的时变方差、尖峰厚尾性、自相关性与有偏分布等特性。最后,基于ARMA-TARCH-M模型,同时使用沪深两市的低频日收益率时间序列数据和5分钟高频收益率时间序列数据进行实证检验,以达到成功拟合中国股票市场波动性的目的,并揭示出中国股票市场波动性的一般规律。

二、 模型的建立

(一) ARMA模型

混合自回归移动平均ARMA模型是同时包含了自回归AR过程与移动平均MA模型的随机过程,该时间序列生成机制综合了自回归项和移动平均项。自回归阶数为m,移动平均阶数为n的ARMA(m,n)过程由式(1) 决定:

(1) 式中:Yt为股票市场收益率时间序列;μ为收益率时间序列Yt的均值;m和n是滞后期数,c为风险溢价参数,φ和θ是待回归估计的参数。式(1) 满足自回归部分的特征多项式的根在单位圆以外的平稳性条件,即有1-φ1z-φ2z2-…-φmzm=0的根的模大于1,而当1+φ1z+φ2z2+…+φmzm=0的根的模也大于1时该ARMA(m,n)过程可逆。ARMA过程的一个显著特点就是其自相关函数和偏相关函数都是拖尾的,这也成为了判定一个线性时间序列是否是ARMA过程的标准。

ARMA模型的关键是确定阶数m与n,Hannan和Rissanen就此提出了他们的识别程序,首先使用OLS对AR(1) 到一个相当高阶的纯AR过程进行估计,随后根据赤池信息准则AIC求得使AICk=

(二) TGARCH-M模型

Engle在对英国通货膨胀问题进行研究时发现,时间序列模型的预测误差决定于扰动项滞后期数,于是他开创性地提出了能够良好刻画金融时间序列异方差性与波动集群性特征的ARCH模型。[2]987-1008该模型包含均值方程与方差方程两部分,其定义表达式如下:

(2) 其中:zt~N(0,1);αi≥0。

Bollerslev把时刻t之前的条件方差也引入到条件方差函数之中,得到了广义GARCH模型,与ARCH模型相比,GARCH模型在方差方程的右边加入中

(三) ARMA-TGARCH-M模型

文章的ARMA-TGARCH-M模型仍然由两部分组成,ARMA条件均值方程与TGARCH条件方差方程。在将条件标准差σt也引入到ARMA条件均值方程之后即可得到ARMA(m,n)-TGARCH(p,q)-M模型。

(3) 其中:yt为股票市场收益率时间序列;μ为收益率时间序列yt的均值;c为风险溢价参数,正值c为股票市场收益率与过去的波动率正相关,而负值c为股票市场收益率与过去的波动率负相关;σt为条件标准差,σt2=Var(εt|It-1)则为关于第t-1期累计信息It-1的条件异方差;dt为股价信息设定的虚拟变量,对股价上涨信息即εt>0时有dt=1,而对股价下跌信息即εt < 0时有dt=0。

三、 数据来源与处理

(一) 样本数据的选取

中国股票市场在实体上主要由上海股票市场和深圳股票市场组成,这二者都是一个庞大的构成。文章通过国泰君安的数据导出功能各选取了中国沪深股票市场最有代表性的一个大盘指数的低频日数据与5分钟高频数据,并以其为代表来对中国股票市场波动性问题进行研究,它们分别是上证综合指数和深圳成份指数。以2006年1月4日至2013年3月4日的日间低频数据和日内5分钟高频数据作为研究样本,共计1 739个交易日。其中,以2006年1月4日至2012年9月3日的日间数据作为日间低频样本,并以2012年9月4日至2013年3月4日的日内数据作为日内高频样本。对于收益率序列,文章采用通用的对数形式生成,即有Yt=lnPt-lnPt-1,文章的所有数据分析与图形生成都通过SPSS 19.0和Eviews 7.2来完成,在软件操作和模型计量过程中分别用SZD、SZD、SCD和SCG表示上证综合指数低频日收益率、5分钟股票收益率、深圳股票市场低频日收益率和5分钟高频收益率。

(二) 基本统计特征分析

上证综合指数和深圳成份指数低频日收益率序列和5分钟高频收益率序列的基本统计分析结果如表 1所示,从中可见,① 上海股票市场低频的日平均收益率小于深圳股票市场,但高频的5分钟平均收益率略高于深圳股票市场,且二者均为正值。表明在文章选取的样本参考期内投资者略有平均正收益,股票市场投资具有正收益性,这也是正常的投资市场所必须给予的投资回报。同时,② 两市低频的日收益率时间序列的极大值与极小值都非常接近10%,而这是自1996年12月16日实行的涨跌停板限价交易制度规定的最高涨跌幅度,整个大盘指数都如此高的涨跌幅度说明上海股票市场和深圳股票市场的波动性非常强,伴有剧烈波动,整个股票市场的投资风险非常大。③ 标准差反映出了波动性的大小,无论是低频收益率还是高频收益率,深圳股票市场的波动性都大于上海股票市场,但二者差距很小。

表 1 上证综合指数与深圳成份指数收益率时间序列的描述性统计特征

文章对两个股票市场两类频率的四组数据都进行了非参数的单样本Kolmogorov-Smirnov检验和Jarque-Bera检验,其原假设是收益序列服从正态分布,但检验结果都在99%的置信水平下拒绝了原假设,从而表明中国股票市场收益率时间序列是非正态分布。理论研究表明,当随机变量服从正态分布时的期望偏度系数是0,而期望峰度系数是3,偏度统计量的绝对值大小表示实数随机变量概率分布的偏斜程度,峰度统计量的绝对值大小表示实数随机变量概率分布的陡峭程度。④ 而文章的经验偏度系数均为负值略小于0,说明中国股票市场收益率时间序列是非对称分布,具有一个很长的负偏态左尾。峰度系数都为正值大于0,表明中国股票市场收益率时间序列的概率分布比标准正态分布更陡峭,是尖峰分布。经验偏度系数与峰度系数说明上海股票市场与深圳股票市场日收益率高于收益率均值的交易天数更多,条件方差的极端值偏多,上海股票市场与深圳股票市场之中确实存在着“尖峰厚尾”性,收益序列是非对称分布。⑤ Jarque-Bera统计量显示出深圳股票市场收益率分布偏离正态分布更远,其收益率时间序列的“尖峰厚尾”性更突出。

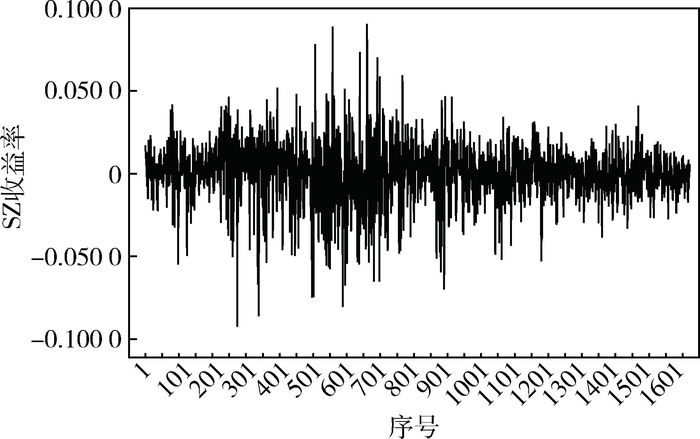

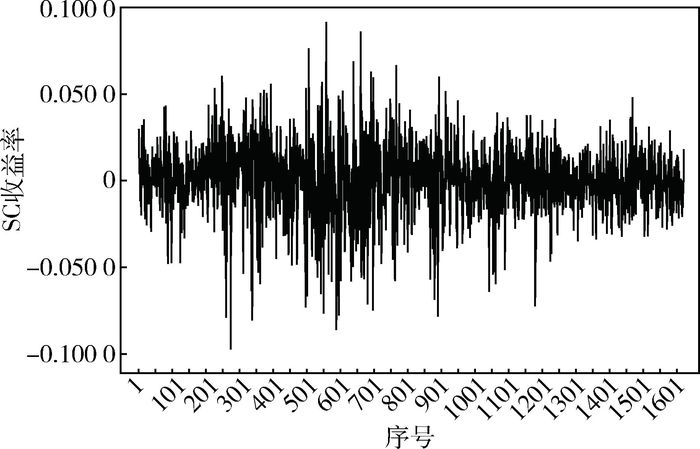

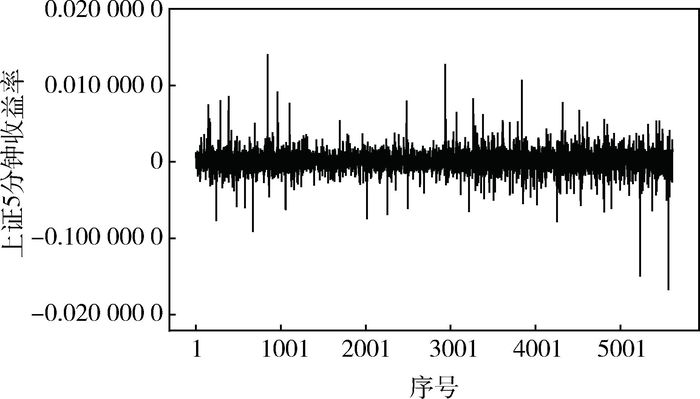

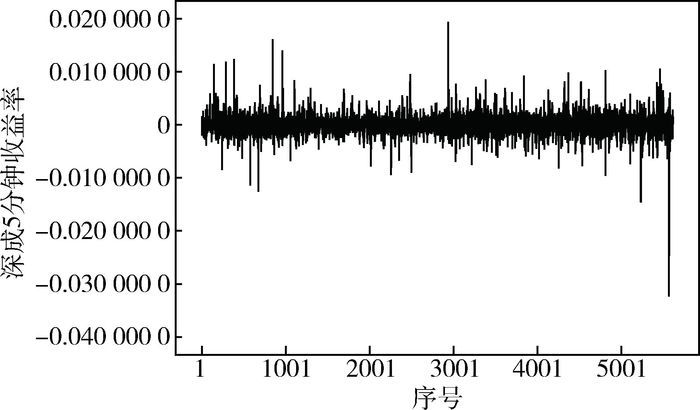

上证综合指数和深圳成份指数低频日收益率序列和5分钟高频收益率序列的序时图如图 1~图 4所示,从中可见,① 在中国股票市场中也存在着收益率波动的集群性,即大波动之后跟随着会有大波动,而小波动之后跟随的也多是小波动。② 两市的收益率波动具有一定相似性,说明中国上海股票市场与深圳股票市场之间存在着某种内在的联动性,但深圳股票市场的波动性要强于上海股票市场,其波动的极端值与频率都更大更高。③ 比较高频数据与低频数据的差异,高频数据所表示的股票市场波动性更小,但与平均波动水平相比其极端值更大,更可能在短期时间内造成极端异常波动。这与人们的一般认识也是一致的,5分钟高频收益率序列对于外部冲击的抵抗力较弱,股票市场的波动性会更多地直接体现为外部冲击,但其恢复力也更强,在某一次的外部冲击造成异常波动之后,会因为冲击影响的消除而尽快恢复其平均水平。而低频日收益率序列是多个高频序列移动平均的综合结果,其抵抗外部冲击的能力更强,出现极端异常波动的可能性较小,但其恢复能力也较弱。因为在这段时间里也许有多个外部冲击同时对股票市场波动产生作用,一个外部冲击影响消除的同时还有其他若干个外部冲击正发挥着作用,股票市场将长久地处于外部冲击影响之下并由此不停地波动。④ 股票市场波动也具有非对称性,即股票市场收益波动在上下两个方向上具有非一致性。

四、 实证分析

(一) 平稳性检验

文章构建的ARMA(m,n)-TGARCH(p,q)-M模型是利用混合自回归移动平均模型来模拟股票市场收益率的条件均值方程,而对金融时间序列进行计量建模分析的一个当然假定就是该时间序列数据是平稳的,因为基于传统计量经济分析方法的估计和检验只有在模型变量满足平稳性要求时才是有效的,否则会出现无意义的谬误回归,所以文章首先对四组收益率时间序列变量进行平稳性检验。在计量经济学中,平稳性被定义为随机变量均值和方差不随时间变化,而任意两期的协方差也仅依赖于时差,不受实际时期的影响。理论界就平稳性检验提出了一些非常有用的判别方法,最主要的就是单位根检验(Unit Root Test),文章运用ADF检验方法检验四组收益率时间序列的平稳性,结果如表 2所示,滞后长度算法遵循施瓦池信息准则(Schwarz Information Criterion)。

表 2 股票市场收益率序列ADF单位根检验结果①

由表 2可知,沪深两市的低频日收益率序列和5分钟高频收益率序列都在0.01的显著性水平下拒绝了相应变量序列存在单位根的原假设,从而说明文章选取的作为样本参考的股票市场收益率时间序列都是平稳的。平稳的金融时间序列具有良好的统计特征,这也说明中国股票市场股票价格基本符合随机游走假说。

(二) 自相关性检验

计量经济学的经典假设之一就是:随机扰动项之间序列不相关,但这在时间序列分析之中遇到了很大的难题,股票市场之中由于存在着信息的传递与市场惯性,因而也往往会表现出自相关性的特征。随机扰动项自相关会导致严重的后果,OLS估计量无偏但达不到最优的要求,标准误也不能对标准差进行无偏估计,参数估计与假设检验的可信度也会严重降低。因此,在进行中国股票市场波动性问题ARMA(m,n)-TGARCH(p,q)-M模型回归分析之前,还需要对时间序列变量进行自相关显著性检验,文章使用Ljung-Box Q检验来考察自相关问题,该检验假设随机扰动项之间序列不相关,当股票市场收益率序列服从AR(p)过程时,Q统计量

表 3 收益率时间序列的自相关检验结果

表 3 收益率时间序列的自相关检验结果

由表 3的检验结果可以看出,自由度从5到20的Ljung-Box Q检验的Q统计量基本都在0.05的显著性水平下拒绝了随机扰动项之间序列不相关的原假设,即上海股票市场和深圳股票市场的低频收益率序列和高频收益率序列都存在着自相关性,并存在着高阶的自相关性。

(三) ARCH效应检验

虽然能够从中国股票市场收益率的序时图看到波动集群性现象的存在,但这种抽象的图形描述并不能准确刻画ARCH效应,更不能准确说明显著性水平等问题,而中国沪深股票市场中ARCH效应的存在正是文章ARMA(m,n)-TGARCH(p,q)-M的一个非常重要的基础假定,如果不存在ARCH效应,那么所有的经验研究都将是没有意义的,因此还要进行ARCH效应的存在性检验。

通过收益率序列的自相关(AC)和偏自相关(PAC)分析可以知道,沪深股票市场低频收益率序列的4阶自相关系数和5分钟高频收益率序列的3阶自相关系数都略小于偏自相关系数,这说明PAC系数对收益率序列的作用更大一些,在这种情况下可以考虑先建立股票市场低频收益率的AR(4) 过程和股票收益率的AR(3) 过程。通过逐步迭代与优化选择得到了四个回归结果,并且,相应回归方程的特征根均大于1,保证了均值条件方程特征根在单位圆以外的稳定性要求,通过Eviews7.2的Make Residual Series功能可以生成相应自回归模型的残差序列,再对生成的残差序列进行ARCH-LM检验,得到结果如表 4所示。

表 4 ARCH效应的ARCH-LM检验结果

由表 4可以看出,LM统计量和F统计量都在0.05的水平下显著,即不存在ARCH效应的原假设被拒绝了,表明在中国上海股票市场和深圳股票市场之中都存在着收益率波动的ARCH效应,即股票市场的波动性之间存在着序列相关,大波动之后跟随着会有大波动,而小波动之后跟随的也多是小波动。

(四) 模型估计

样本收益率序列满足经济计量建模分析的平稳性要求,自相关性的存在使得文章在构建收益率时间序列的ARMA模型时具有极大的合理性,ARCH效应又使得文章能够顺利运用ARCH类模型对中国股票市场波动性问题进行拟合研究,这些检验都为文章进行ARMA(m,n)-TGARCH(p,q)-M模型的构建与经验数据实证回归分析提供了合理的支持。

由自相关性检验和ARCH效应检验可知,上证综合指数日收益率存在着高阶自相关性,文章先构建收益率时间序列的混合自回归移动平均ARMA过程,通过逐步迭代和优化选择,同时按照赤池信息准则(AIC)和施瓦池信息准则(SIC)决定出最优的(m,n)阶数并采用简单最小二乘法OLS估计得到了上证综合指数低频日收益率的最优过程,由自相关性检验可知p不大于5,q不大于4,AIC和SIC选择过程如表 5所示。

表 5 ARMA(m,n)模型的AIC与SIC决定

由于赤池信息准则AIC与施瓦池信息准则SIC的判定结果并不一致,所以文章对最优的几个ARMA过程进行比较,并最终选择了ARMA(2,2) 过程作为上证综合指数低频日收益率序列的生成过程,ARMA(2,2) 过程的估计结果如下:

(4) ARMA(2,2) 过程表示的条件均值方程估计效果非常好,所有系数都满足0.01的显著性水平要求。再考虑条件方差方程部分,并引入考虑了杠杆效应的虚拟变量dt和风险溢价参数c,从而构造了ARCH-TGARCH-M计量模型,由于在条件均值方程伴有方差条件方程ARCH的同时会有个别均值方程中的系数不再满足显著性要求,故可将其剔除后再次回归。经过逐步选择即可得到本文的上证综合指数低频日收益率的最优ARMA(2,2)-TGARCH(1,1)-M模型回归估计结果:

(5) 按照同样的理论原则和回归方法还可以得到深圳成份指数低频日收益率和沪深两市5分钟高频收益率时间序列的ARCH-TGARCH-M模型估计结果,在四个回归模型中均取μ=0,Threshold选择1,ARCH-M均值服从t分布,所有回归估计结果如表 6所示。

表 6 ARMA(m,n)-TGARCH(p,q)-M模型估计结果

由表 6的估计结果可知,ARMA(2,2)-TGARCH(1,1)-M模型和ARMA(3,3)-TGARCH(2,2)-M模型能够分别很好地拟合上海股票市场和深圳股票市场的日收益率波动问题,而ARMA(4,2)-TGARCH(1,3)-M模型和ARMA(5,3)-TGARCH(2,3)-M模型则能够分别很好地拟合上海股票市场和深圳股票市场的5分钟高频收益率时间序列的波动问题,并由参数估计可以得到以下主要结论:

第一,深圳股票市场收益率比上海股票市场收益率有更高阶的自相关,5分钟高频收益率比低频日收益率有更高阶的自相关。上海股票市场低频日收益率的滞后项回归系数大于0,说明上海股票市场收益率存在着惯性,当前收益率会延续以前的收益率变化趋势,而历史收益率又会对当前的股票市场收益率产生正反馈影响,其λ值等于99.56%,收益率信息基本得到了完全继承。对于深圳股票市场的低频日收益率,历史收益率对于当前收益率的作用影响有两个方面,近期的历史收益率影响为正,而远期的历史收益率对当前收益率的影响为负,这种滞后历史收益率对于当前收益率的最终影响需要比较两种正负影响的相对大小,但在一般情况下其决定作用多是正向的,且小于上海股票市场。对于高频收益率的考察,其历史收益率的反馈作用主要表现为负方向,深圳股票市场的显著性回归系数更是全部为负值,其值也比上海股票市场更大,这种现象可以用均值回归理念进行很好地解释,投资者认为股票收益有向收益均值靠拢的趋势,因而任何收益都存在反转的可能,短时间就表现为股票收益率的负反馈效应。

第二,中国股票市场的投资风险较大,投资者的投资行为仍有较大盲目性,条件标准差表示的溢价风险并没有在股票市场预期收益率中得到良好体现,股票市场收益率与历史波动之间并不存在统计学意义上的显著关系。上海股票市场的风险溢价参数大于0,而深圳股票市场的风险溢价参数小于0,说明上海股票市场的低频日收益率和5分钟高频收益率都与市场风险水平呈微弱的负相关,而深圳股票市场的收益率与市场风险水平呈微弱的正相关关系。这说明条件方差变大时风险增加能够在深圳股票市场的预期收益率中得到体现,但上海股票市场的预期收益率中并没有完全体现溢价风险。由此可知,中国股票市场的风险传递机制虽然发挥了一些作用,但还有加强与完善的空间,投资者的投资理念也不够成熟,因此,需要适当引导股票市场投资者增强风险意识,转变盲目投资做法。此外,上海股票市场的低频日收益率的条件标准差系数要大于深圳股票市场,但时间更短的5分钟高频收益率的条件标准差系数要小于深圳股票市场,说明当沪深两市进行比较时,上海股票市场投资者要求更高的日期望收益率,而深圳股票市场投资者要求更高的高频期望收益率,其投机性强于上海股票市场,高频时间的短期行为更突出。

第三,方差方程中所有扰动项的系数都大于0,即条件方差与t时刻之前的扰动项正相关,也就是说以前的随机扰动会正向决定当前的条件方差,这就从经验研究的角度说明了中国股票市场中“波动集群”性的存在,即大波动之后跟随着会有大波动,而小波动之后跟随的也多是小波动。此外,方差方程中t期以前的条件方差系数表示了波动的持久性,上证综合指数低频日收益率的β=0.938 3,于是β72=0.010 2,也就是说上证综合指数的TGARCH(1,1) 过程的波动持续性非常强,股票市场的外部冲击对条件方差的波动性影响要在72天之后才会基本消失,这与蒋祥林等250个交易日的波动持续期的结论有所不同,同时,深圳成份指数日收益率的波动持续期达到了47天,二者共同说明了中国股票市场存在着较长的外部冲击波动持续期。[28]中国自1996年12月16日实行的涨跌停板限价交易制度也对这一结果有非常显著的影响,涨跌停板制度虽然能够减少股票市场的剧烈波动,防止了极端大幅度波动的出现,但却也不利于股票市场消化外部冲击信息,一个外部冲击需要较长的时间才能完全被股票市场吸收。此外,5分钟的高频收益率的波动性持续期没有低频日收益率那么长,上证综合指数的外部冲击波动能够持续42个交易单位时间合计3个半小时,而深圳成份指数的外部冲击波动仅能够持续20个交易单位时间合计100分钟,达到了上海股票市场的一半。比较沪深两市的波动持续期,无论是低频日收益率,还是5分钟高频收益率,上海股票市场的波动持续期都比深圳股票市场长,说明上海股票市场波动具有更强的长记忆性。

第四,中国股票市场波动具有显著的杠杆效应。在文章的ARMA-TGARCH-M模型中,杠杆效应由εt-12dt-1的估计系数体现,当存在股价上涨信息即εt>0时有虚拟变量dt=1,而存在股价下跌信息即εt < 0时有dt=0。当φ≠0时说明股票市场信息冲击作用非对称,而φ < 0则说明在股票市场的信息冲击中具有杠杆效应。文章所有的杠杆效应估计参数都小于0,说明当产生了正的股价信息冲击时其条件方差σt2要小于负的股价信息冲击时的条件方差,即相同程度的利空冲击对中国股票市场的股价波动影响要比利好冲击更大,这就反映出正负信息冲击对于股票市场股价波动的不均衡影响,即中国股票市场波动存在着显著的杠杆效应。同时,φ的大小反映了杠杆效应的大小,经验估计结果表明,深圳股票市场波动的杠杆效应要显著大于上海股票市场,高频收益率波动的杠杆效应也要显著大于低频的日收益率波动。这种杠杆效应多是因为股票市场投资者的从众行为导致,其自身缺乏关于股票市场投资的信息收集识别能力与投资分析能力,在股票市场暂时性的负冲击出现时会不理智地和其他投资者一起抛出股票,容易导致“羊群负效应”,从而诱发股票市场收益率的整体加剧下滑;而在正冲击出现时又因为获利了结而在一定程度上抑制了股票市场向上的走势,整体上就表现为同样的信息冲击使股票市场下滑更多,而上扬相对较少。显著的杠杆效应再次证明了中国股票市场投资意识的不成熟,对投资者的宣传教育力度还应加大。

最后,文章再次对表 6的ARMA(m,n)-TGARCH(p,q)-M模型拟合估计结果的残差项分别进行了ARCH-LM检验,该检验假设残差项不存在ARCH效应,结果四个残差项都不满足显著性要求,从而接受了不存在ARCH效应的原假设,说明经过ARMA(2,2)-TGARCH(1,1)-M模型、ARMA(3,3)-TGARCH(2,2)-M模型和ARMA(4,2)-TGARCH(1,3)-M模型以及ARMA(5,3)-TGARCH(2,3)-M模型对相应的中国股票市场收益时间序列进行拟合后,消除了其条件方差,从而明显降低了中国股票市场收益率时间序列的波动性。

五、 研究结论

文章通过构建股票市场收益率时间序列的ARMA模型,并利用TGARCH-M模型处理金融时间序列的时变方差问题,最终建立了文章考察股票市场波动性问题的ARMA-TGARCH-M模型,并以上证综合指数和深圳成份指数作为上海股票市场和深圳股票市场的代表,同时运用低频日收益率数据与5分钟高频收益率数据进行了实证检验,通过对中国股票市场收益率波动性问题的分析研究,得到了以下结论。

第一,中国股票市场的平均收益率为正值,反映了承担投资风险而要求的必要收益,但条件标准差表示的额外风险并没有在股票市场预期收益率中体现,同时,中国股票市场收益率也存在着大幅度的波动,这些都说明中国股票市场总体风险较大,深圳股票市场收益率的波动性也要略强于上海股票市场,其波动幅度和频率都略大于上海股票市场。此外,中国股票市场收益率波动还存在着波动集群性、尖峰厚尾性与非对称分布等特征,深圳股票市场在各方面的特征也都比上海股票市场突出。

第二,无论是上海股票市场,还是深圳股票市场,无论是低频日收益率,还是高频的5分钟收益率,其收益率时间序列都具有显著的平稳性、自相关性,以及作为文章计量模型假定的显著的ARCH效应,当运用ARMA-TGARCH-M模型进行回归拟合后再对残差项进行ARCH-LM检验,其ARCH效应被消除,从而明显降低了中国股票市场收益率的波动性。GARCH族模型能够很好地拟合中国股票市场波动性问题的特点。

第三,深圳股票市场收益率比上海股票市场有更高阶的自相关,5分钟高频收益率比低频日收益率有更高阶的自相关。上海股票市场的历史日收益率会对当前收益率产生正反馈影响,其继承率达到了99.56%,而深圳股票市场日收益率的影响也多以正反馈为主,但其作用远小于上海股票市场。5分钟高频收益率的反馈作用全部为负,可能存在着均值回归理念的影响。

第四,经验数据说明中国沪深股票市场都存在着波动集群性,而股票市场外部冲击对中国股票市场波动的影响具有持续性,上海股票市场日收益率的外部冲击波动持续期是72个交易日,深圳股票市场日收益率的外部冲击波动持续期是47天,说明中国股票市场存在着较长的外部冲击波动持续期。最后,中国股票市场波动也存在着显著的杠杆效应,同时,深圳股票市场波动的杠杆效应要显著大于上海股票市场,高频收益率波动的杠杆效应也要显著大于低频的日收益率波动。

注释:

① p值计算通过渐进卡方分布完成。

-

表 1 上证综合指数与深圳成份指数收益率时间序列的描述性统计特征

表 2 股票市场收益率序列ADF单位根检验结果①

表 3 收益率时间序列的自相关检验结果

表 4 ARCH效应的ARCH-LM检验结果

表 5 ARMA(m,n)模型的AIC与SIC决定

表 6 ARMA(m,n)-TGARCH(p,q)-M模型估计结果

-

[1] BLACK F. Studies of stock market volatility changes[R].Proceedings of the American Statistical Association, Business and Economic Statistical Section, 1976:177-181.

[2] ENGLE F. Autoregressive conditional heteroskedasticity with estimates of the variance United Kingdom inflation[J]. Econometrica, 1982(4):987-1008.

[3] BOLLERSLEV T. Generalized autoregressive conditional hetero-skedasticity[J]. Journal of Econometrics, 1986(3):307-327.

[4] NELSON B. Conditional heteroskedasticity in asset returns-a new approach[J]. Econometrica, 1991(3):47-70.

[5] ZAKOIAN J. Threshold heteroskedastic models[J]. Journal of Economic Dynamics and Control, 1994(18):202-226.

[6] CLARK K Y, THOMAS S H. The integration and efficiency of international bond markets[J]. Journal of Business, 1973(4):31-50.

[7] TAYLOR S. Modeling financing time series[M]. New York:Wiley, 1986:62-95.

[8] TAUCHEN H, PITTS M. Threshold models in nonlinear time series analysis[J]. Springer, 1983(35):271-290.

[9] KIM S, SHEPHARD N. Comment of bayesian analysis of stochastic volatility[J]. Journal of Business and Economics Statistics, 1998(4):371-471.

[10] KOOPMAN S, USPENSKY E. The Stochastic volatility in mean model:Empirical evidence from international stock market[J]. Journal of Applied Econometrics, 2002(6):667-689.

[11] LO A W. Long-term memory in stock market prices[R]. Cambridge, Massachusetts:National Bureau of Economic Research, 1989:NO.2984.

[12] KAROLYI G A. A multivariate garch model of international transmissions of stock returns and volatility:The case of the United States and Canada[J]. Journal of Business and Economic Statistics, 1995(1):11-25.

[13] ANDERSEN T G, BOLLERSLEV T, DIEBOLD F X, et al. Exchange rate returns standardized by realized volatility are gaussian[J].Multinational Finance Journal, 2000(3):159.

[14] FORNARI F, MELE A. Financial volatility and economic activity[J].Journal of Financial Management, Markets and Institutions, 2013, 1(2):155-198.

[15] 翁黎炜, 黄薇.中国股市ARCH效应分析——基于沪市A股实证分析[J].财经界(学术版), 2010(2):18-19. [16] 张婧.基于上证指数的中国股市ARCH效应分析[J].价值工程, 2014(32):230-231. [17] 文凤华, 刘晓群, 唐海如, 等.基于LHAR-RV-V模型的中国股市波动性研究[J].管理科学学报, 2012, 15(6):59-67. [18] 邓晓益, 郭庆春.证券市场成交量对收益率波动性影响的实证分析[J].上海金融学院学报, 2007(3):27-31. [19] 周孝华, 吴命.基于EC-EGARCH-M模型的沪深股市波动性研究[J].软科学, 2010(1):126-130. [20] 陈其安, 张媛, 刘星.宏观经济环境、政府调控政策与股票市场波动性——来自中国股票市场的经验证据[J].经济学家, 2010(2):90-98. [21] 梁益年. 股票市场波动性传递的多维GARCH分析[D]. 杨凌: 西北农林科技大学, 2009. [22] 郑冲. 中国股市波动性的影响因素研究——基于多因素交互效应的视角[D]. 北京: 北京交通大学, 2012. [23] 鲁万波.基于非参数GARCH模型的中国股市波动性预测[J].数理统计与管理, 2006(4):455-461. [24] 杨二鹏, 张德生, 李文静.基于非参数模型的沪深300指数波动性研究[J].纺织高校基础科学学报, 2010(1):42-45. [25] BAILLIE R T. Long-memory processes and fractional integration in econometrics[J]. Journal of Econometrics, 1996(1):5-59.

[26] HANNAN E, RISSANEN J. Recursive estimation of mixed autoregressive-moving average order[J].Biometrika, 1982(1):81-94.

[27] ENGLE R, LILIEN D, ROBBINS R. Estimating time varying risk premia in the term structure:The ARCH-M Model[J]. Journal of the Econometric Society, 1987(2):391-407.

[28] 蒋祥林, 王春峰, 吴晓霖.基于状态转移ARCH模型的中国股市波动性研究[J].系统工程学报, 2004(3):273.

下载:

下载: